Reasons to Switch to EV

- Say goodbye to rising fuel costs

- A multitude of makes and models are now applicable for the FBT exemption

- FBT exemption applies to Battery Electric, Hydrogen Fuel Cell Electric and Plug-In Hybrid Electric Vehicles

- No GST to pay on purchase price or runnings costs of your EV

- Every dollar is deducted pre-tax on applicable EV's

The Electric Car Discount: Big savings now available

The Electric Car Discount provides a Fringe Benefits Tax (FBT) exemption for Electric Vehicles (EVs) below the luxury car tax threshold (LCT) of $91,387 when financed under a novated lease.

This discount reduces the cost of eligible EVs to make the transition to electric vehicles as cost effective as possible, including:

- EVs first held and used after 1 July 2022

- Battery EVs

- Plug-in hybrid EVs (available until 1 April 2025)

Overview of the FBT Exemption

The EV exemption is a policy designed to encourage the adoption of electirc vehicles by offering favourable tax treatment under novated lease arrangements. This exemption can significantly reduce the Fringe Benefits Tax (FBT) liabaility for employers and employees, making electric vehicles an attractive and cost effective option.

The Savings in action

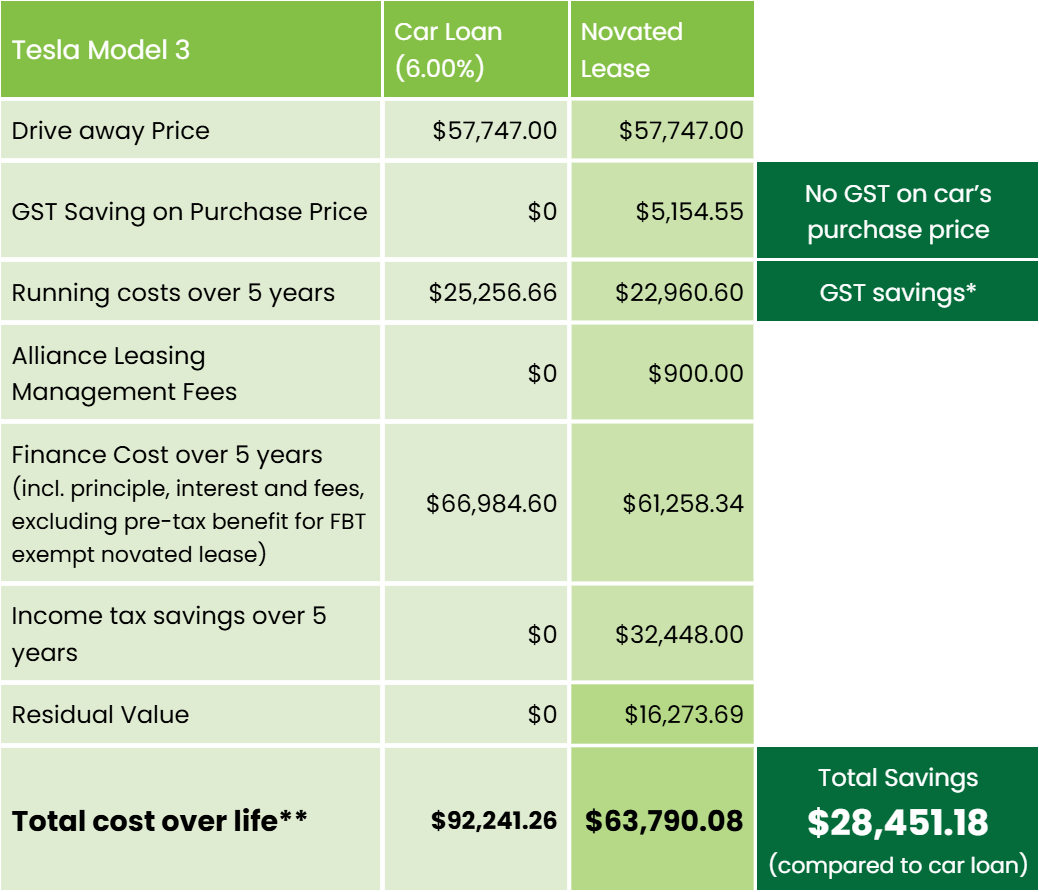

For a new Tesla Model 3 Rear-Wheel Drive on a novated lease see how this compares to taking out a consumer loan.

*Based on an individual earning $100,000 per annum, driving 15,000km per year over a 5 year term. Consumer loan interest rate is calculated at 6.09%.